Silver was once the absolute king of ancient finance. Everything was priced in silver, and possessing 100 pounds of silver was once synonymous with being an ultra-wealthy individual in medieval Europe. However, in recent decades, silver prices have plummeted dramatically. Similarly, grain prices have also collapsed when compared to ancient times. The primary cause behind these price drops is humanity’s technological revolution. Nevertheless, in recent years, gold and silver prices have shown signs of recovery.

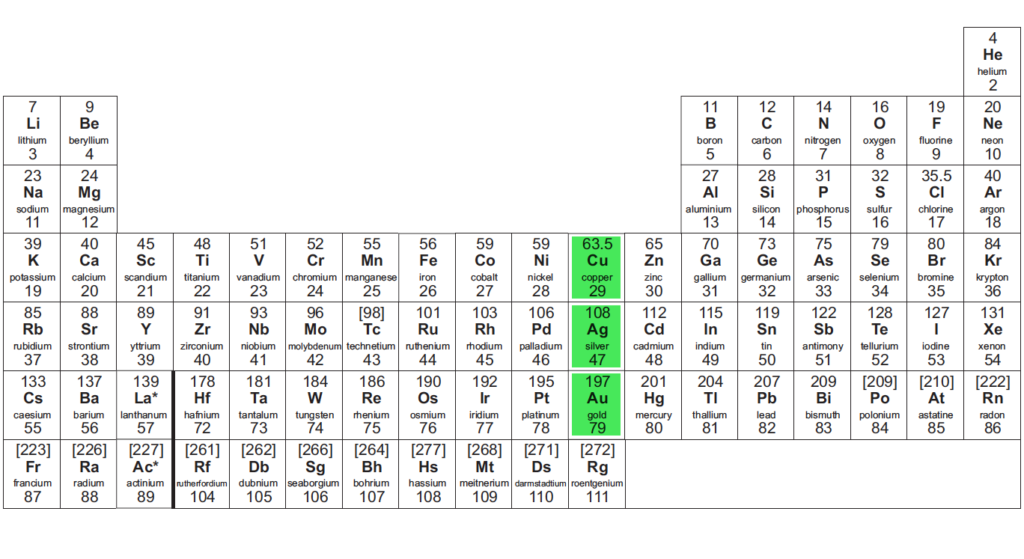

In the periodic table, silver is located in the 11th column, alongside copper and gold, all belonging to the same group. These three metals were historically well-known as monetary materials. The rarity of silver lies between copper and gold—each ton of Earth's crust contains approximately 0.07 grams of silver, compared to 60 grams of copper and just 0.0011 grams of gold.

Why Did Silver Prices Collapse?

The first major reason for the collapse of silver prices in modern times is the removal of its status as legal tender. In ancient times, high-ranking officials and wealthy individuals often hoarded silver, burying large amounts underground, effectively removing it from circulation. Meanwhile, all market transactions required silver, leading to severe shortages.

However, after silver lost its role as legal currency, transactions transitioned to paper money issued by various nations. Wealthy individuals no longer needed to store astronomical amounts of silver underground. Unlike oil, silver is not a consumable resource—it can be preserved almost indefinitely. When silver was used merely as a medium of exchange, its wear and tear were minimal.

With the removal of silver from monetary circulation, all the silver mined over thousands of years was suddenly released into the market, yet there was no longer demand for it as a transaction medium. Only industrial applications and jewelry-making required silver, while the general public had little use for it. This severe supply-demand imbalance led to a sharp decline in silver prices.

A similar fate befell gold, which also experienced a decline. However, the drop in silver prices was far steeper than that of gold. The primary reason for this is the technological revolution in silver production, which drastically increased supply.

The Rise of Modern Silver Production

In ancient times, producing silver required finding and mining rich silver deposits. Since high-grade silver ores were rare, production remained limited. Even today, silver mines are scarce, and modern geological surveys have identified only a few high-yield veins.

According to the U.S. Geological Survey, global silver mine reserves stood at approximately 550,000 tons in 2022. These reserves are mainly concentrated in the Pacific Rim tectonic belt, with Peru, Australia, and China holding half of the world’s known silver resources.

One of the most famous silver mines in history, the Potosí mine, continues to produce silver today. Over its lifetime, it has yielded more than 40,000 tons of silver. The entire mountain is rich in silver, with ore containing up to 40% silver content, making it a true "Silver Mountain." During its peak, Potosí supplied half of the world's silver production and was the largest silver mine in medieval South America. However, by the 19th century, as resources were depleted and silver prices declined, Potosí lost its former glory.

Modern advancements have revolutionized silver production. Scientists discovered that trace amounts of silver exist in copper, lead, and zinc ores. Although the silver content in these ores is significantly lower than in pure silver deposits, the sheer volume of copper and aluminum ores compensates for this. By using electrolytic refining to extract copper and aluminum, silver accumulates at the electrodes, allowing for easy recovery of high-purity silver. This method ensures that any metal refined through electrolysis yields a small amount of silver as a byproduct. Even though a ton of copper or aluminum ore contains only a minute amount of silver, large-scale production results in an astonishing total silver output.

Today, silver is primarily used in four areas:

- Industrial Applications – The largest and fastest-growing demand for silver comes from industries. Due to its excellent electrical conductivity, thermal conductivity, flexibility, and ductility, silver is an irreplaceable strategic resource.

- Photographic Materials – Silver compounds are essential in high-quality imaging.

- Jewelry and Artisanal Crafts – Silver remains a staple in decorative items and luxury goods.

- Precious Metal Investments – Silver is used as a store of value, similar to gold.

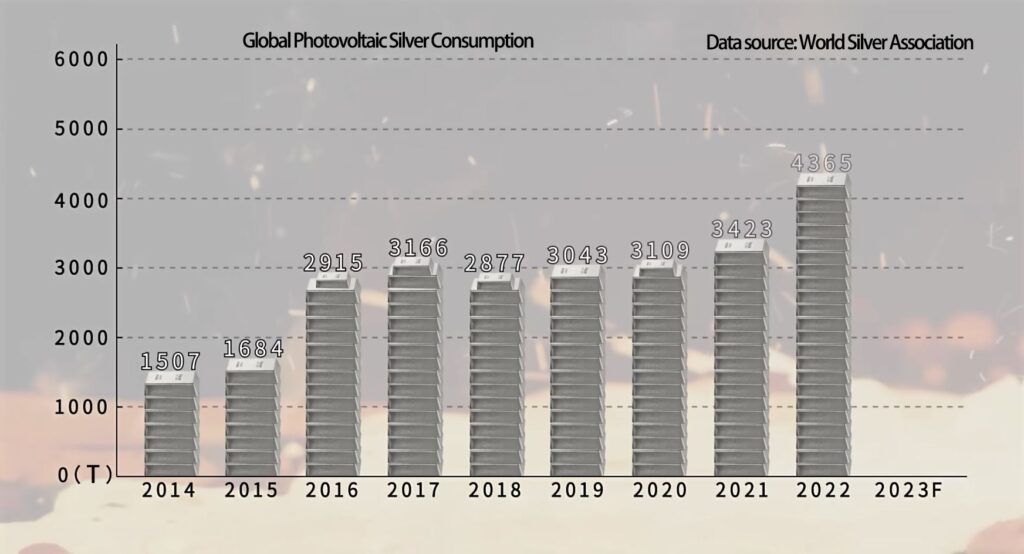

In recent years, industrial silver consumption has grown steadily, reaching 17,309 tons in 2022. The biggest increase comes from battery production, especially photovoltaic (solar) cells. For instance, a smartphone requires 0.2–0.3 grams of silver, a laptop needs 0.75–12.5 grams, but a single photovoltaic cell can require up to 20 grams.

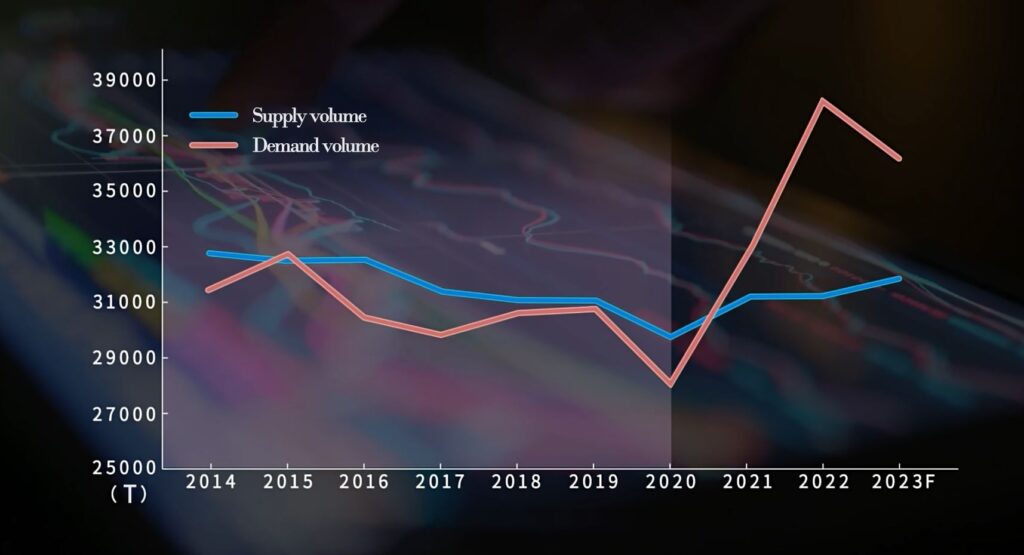

Between 2014 and 2022, silver demand for photovoltaics surged from 1,500 tons to over 4,000 tons, significantly driving up silver prices. From 2014 to 2019, global silver supply exceeded demand, leading to a price slump. However, since 2020, silver demand has surged, consistently outpacing supply. In 2022, global silver demand reached 38,000 tons, while total supply was only 31,000 tons, resulting in a deficit of over 7,000 tons.

Today, silver is being mass-produced and consumed at an unprecedented rate. It is now treated more like an industrial metal, much like steel, rather than the precious asset it was in ancient times. This marks a stark contrast to the past, where silver was hoarded and treasured by the wealthy.

Predicting Silver Prices Using Gold

Recent price increases in gold and silver can be attributed to global inflation, economic and geopolitical uncertainties, and market sentiment. There are two key patterns that can help predict silver’s price movements based on gold prices:

- Silver Lags Behind Gold – When major global events, such as wars, occur, gold prices rise first. After a period of sustained gold price increases, silver follows suit, moving in the same direction. If gold reaches a new high, silver is likely to do the same within a few months.

- The Gold-Silver Ratio – Over the past 20 years, gold has been priced roughly 70 times higher than silver. Historically, whenever the ratio exceeds 90, silver tends to rise, bringing the ratio back to around 70. Conversely, when the ratio drops below 40, silver prices typically decline soon after.

In conclusion, silver has transitioned from being the foundation of ancient monetary systems to a vital industrial resource in the modern era. Although its historical role as currency has faded, its importance in technology and renewable energy ensures that silver will remain a valuable commodity in the years to come.